Election topic: The Mysterious Black Box Known as Green Knight Economic Development Corporation, a Non-Profit Land Development Company

Meetings are

private, there is no accountability whatsoever, and six of the board members

have been on GKEDC since its inception in 1999. It may sound like a

positive for an organization to be "apolitical," but GKEDC is

secretive and opaque. If Green Knight actually represented the

communities, Synagro would not even have been invited into the Slate Belt in

2017. It is not a coincidence that two local businessmen resigned from

GKEDC when the Synagro project was announced.

Carlton Snyder, Green Knight President for 22 years, stated in 2017 that "contractual obligations" were a factor in Green Knight choosing to support the project. This implies that the minimal benefits to the community of the Synagro project that GKEDC claimed to exist, without any input from the municipalities, were secondary to a secret contract GKEDC has with the landfill associated with GKEDC's waste heat. There is no other explanation for Green Knight passing on as little as $100,000 a year total to the municipalities, in exchange for Synagro receiving over $2 million worth of energy. Green Knight buys the landfill gas that it burns, so it is either very poor at valuing its assets, did not have the ability due to a contract with Waste Management to receive a fair rate for the byproduct of converting fuel it owns to electricity, or was planning to retain income though it is a nonprofit. During the Synagro review, the Synagro Project Manager stated that the arrangement for paying for waste heat was “complicated”, consistent with Green Knight not being able to sell its own waste heat at even 1/10 fair market value. The Synagro proposal revealed that Green Knight today represents the welfare of Waste Management more than that of the three communities it is to benefit.

Ron Angle and Dr.

John Reinhart attended a few of the first Synagro review meetings. Based on the project being totally

counter to economic development and the health of citizens in the Slate Belt, they published an

opinion that Green Knight has lost its way (click image):

After 2013, Green Knight reduced its giving from over $100,000 annually to an average of only $36,398* over the next seven years, $12,000 of this is for scholarships. Giving of significant amounts of $5000 or more is now confined to only Families First and Blue Mountain Library. These are laudable causes, but so are all the other organizations that used to receive similar much needed aid – like the athletic association, the fire department, school sports teams uniforms and equipment, etc. No longer are these causes receiving badly need aid from Green Knight. I recently met a person who led an athletic organization for kids who told me “we received $5,000 each year, and then it stopped. Green Knight said they would return to giving, but they did not, and that was 8 years ago. We counted on that funding.” A similar story was told by another person I met who is associated with a fire company.

* For the years 2013 through 2019, GKEDC’s IRS 990 forms show a total net income of $3,112,655 and total giving of $254,785. GKEDC passed on only 8.2% of the net income it generated in this period.

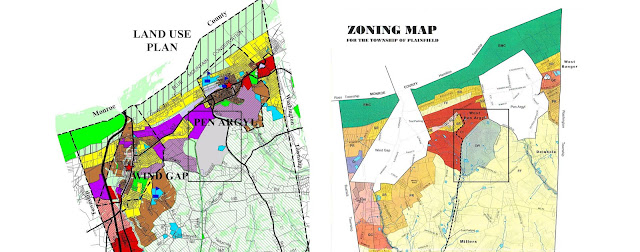

What is GKEDC, a non-profit, planning for the net income it is keeping? There is no way of knowing due to a complete lack of transparency, but in light of the Green Knight Industrial Park II project on the former Beers property in Wind Gap, it appears that Green Knight has reimagined itself as a real estate development company.

If I am elected supervisor, I will advocate for more transparency from Green Knight. It is unacceptable that the communities do not understand the “contractual obligations” that exist between Waste Management and GKEDC, since GKEDC is a non-profit that exists to benefit the citizens of our three municipalities. I will also advocate for Green Knight to return to direct giving as is customary for a charitable organization, so that our youth and volunteer organizations benefit directly and immediately, rather than an unspecified future return on investment through speculative investments in warehouses or other real estate development.

Comments

Post a Comment